Client-led change – Toward a more perfect legal market

As ‘Toward a more perfect legal market‘ demonstrates, D. Casey Flaherty is fast becoming one of the most influential commentators on the trends in the BigLaw supply chain. Courtesy of Casey, this post is reproduced from the 3 Geeks and a Law Blog where it first appeared on May 9, 2016. Casey makes a cogent case for research into reducing information asymmetry and increasing transparency in the legal services supply chain.

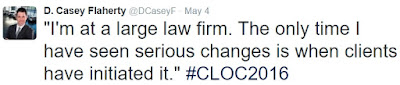

The CLOC Institute last week was phenomenal. I barely tweeted because I was so engaged by the content and conversation. I did, however, transcribe one quote that got some attention from the legal commentariat:

I gravitated to the quote because it was consistent with my pre-existing notions of the role clientsand structured dialogue play in driving improvements in legal service delivery. But because the statement only reinforced my extant beliefs, it did not inspire any sort of reflection. Another speaker from the same Big Thinkers panel, however, added another dimension to my musings on collective conversations.

Firoz Dattu used to teach economics at Harvard. Among many other cogent points, he talked about getting past the failings of individual firms and thinking more about how we can correct market failures. In particular, he emphasized the lack of perfect information. As someone who has long labeled law a credence good subject to Baumol’s cost disease, this observation resonated with me.

Toward a more perfect legal market

In a perfect-information condition, all consumers and suppliers have perfect knowledge of price, utility, quality, and production methods. This differs from omniscience. Perfectly knowledgeable participants can still compete. Chess is a competitive game with perfect information. Both players have seen every move and can derive the range of possible future moves from the rules.

Backgammon is also a perfect-information game despite the role of the dice. Rolling the dice introduces quantifiable exogenous uncertainty from chance events—i.e., we do not know what numbers will come up, but we do know the range of possibilities and their probabilities. Working from a fresh deck, blackjack and poker with all cards facing up would be perfect information games. But stacked decks and hidden cards result in an imperfect-information condition and also much of the fun of gambling.

Legal action is a gamble with plenty of stacked decks and hidden cards. There are known unknowns and unknown unknowns that drive activities like discovery and due diligence. But even the basic decisions, like which lawyer to hire, are fraught with imperfect information. With the billable hour still dominant, we are generally guessing about price. With contingent outcomes, we have limited ability to judge utility. We have almost no barometer of quality apart from the poor proxy of pedigree. And we harbor deep suspicions but traditionally have had no real transparency into production methods.

We can’t eliminate risk or uncertainty. We can’t have perfect information. So shouldn’t we just get back to doing the law stuff? This is the point where many market participants throw up their hands. Having cogitated for a few painful minutes, most people return to their days jobs with some implicit, if grumbling, acceptance of the status quo.

Firoz Dattu is not most people. One of the founders of the General Counsel Roundtable (now CEB Legal Leadership Council), Dattu is the CEO of AdvanceLaw. AdvanceLaw has brought together the GC’s of over 100 of the largest corporate clients (e.g., Google, McDonald’s, Nike, Sony, Deutsche Bank, Mastercard) into something that looks from afar like a loose consortium. Rather than buying together, the GC’s of these legal service consumers pool resources to vet law firms and, once firms qualify for the go-to list, commit to sharing feedback on quality of service.

Without data you’re just another person with an opinion

But how much can you really vet law firms? Law firms look pretty much the same. There are no agreed upon measures of quality. Likewise, there are no bright lines for judging outcomes. Who is the better trial attorney: the one who ‘won’ a case that should have been worth $10M to the plaintiff or the one who ‘lost’ the case while limiting the damages paid by the defendant to $100K? How do we measure the outcome if the parties avoided trial by settling for $1M? How do we evaluate the deal or contract that never resulted in litigation? As Deming said, “Without data you’re just another person with an opinion.”

That is probably what it would be: opinion. I don’t have any insight into the AdvanceLaw methodology, but I suspect it involves a fair amount of subjective evaluations on both the front and back end. Kind of like Yelp or the reviews on Amazon. Not exactly hard science.

But it does not need to be hard science to be useful. General accuracy is preferable to false precision. I find the scores on Yelp and Amazon to be quite informative (and AdvanceLaw is far less susceptible to fake reviews). Customer satisfaction is inherently subjective but terribly important. Knowing that 100 people subjectively determined they enjoyed a meal is a better guide to action than having a precise measurement of the max temperature of the oven in which the food was cooked.

While we can’t have perfect information, we can have better information. We can reduce, rather than eliminate, risk and uncertainty. A few well-informed customers sharing their opinion provides infinitely more information than nothing and is more credible than advertising (either you have no information or you believe what the seller tells you). There are numerous methodologies for capturing qualitative metrics. But these measurement methodologies work best with scale and diversity of sources—the two things the AdvanceLaw loose consortium approach provides.

Think about the advantages from the buyer’s perspective. One major barrier to dynamism in the legal market is high switching costs. Despite long-standing dissatisfaction with their incumbent law firms, client purchasing behavior reflects a devil-you-know conservatism. This behavior is rational in a low-information condition where the primary method to determine if there is a better alternative is a resource-intensive vetting process followed by a risk-intensive trial run.Pooling resources on the vetting process reduces the burden. Sharing feedback reduces the risk—someone credible has already done the trial run. The formal system for building reputational capital also creates an extra level of market discipline for the participating firms because a bad customer experience will have effects beyond the individual client relationship. Law firms go from operating in an environment where they are almost guaranteed that their performance will not be shared to an environment where they are almost guaranteed that it will. Incentives affect behavior.

Clients are not the only ones who suffer from an information deficit. Firms believe they do great work. But only a third of corporate counsel would actually recommend their primary law firm to a peer. Returning to the quote that opened the post—“I’m at a large law firm. The only time I have seen changes is when clients have initiated it”—think about the advantages from the seller’s perspective. Single-source vetting combined with a robust feedback mechanism from over a hundred clients does more than preserves resources. It introduces consistency and transparency.

Often, law firms that do not get past the vetting process have no idea why. Those that make it on a panel list then have little insight into the circumstances that lead to the ebbs and flows of business volume. The conventional way to fire a law firm is to stop calling them. The lack of dynamism among law firms is not just because clients don’t switch often. Clients’ reasons for switching, or not, are usually opaque.

Moreover, the dynamism driven by better information is not limited to individual clients and firms. There are system implications. Where thorough vetting and detailed, quantified feedback displace brand and pedigree as indicia of quality, the playing field becomes leveled for smaller firms and challengers. This does not necessarily presage the death of BigLaw, but it does intensify competition and accelerate the pace at which law firms are remade.

Need for a better market

I’ve been focused on information problems for years with my Service Delivery Review and Legal Tech Assessment. The market needs more information. But the market also needs to be structured in a way that facilitates the dissemination of information. Recently, I’ve been reflecting about the roles played by geography (Toronto) and organization (CLOC) but Dattu, along with some exciting things my friend Bill Henderson is working on, has really got me ruminating on the importance of collective feedback loops. Structured dialogue is a powerful feedback mechanism, but it can be amplified if it is embedded in the proper collective structure.

We need to make a better market rather than focus on the shortcomings of individual market participants.

Author

D. Casey Flaherty is a consultant who worked as both outside and inside counsel.

D. Casey Flaherty is a consultant who worked as both outside and inside counsel.

More about his writing may be found here. You can connect with Casey on Twitter and LinkedIn or by email at casey@procertas.com.

If you’re wondering about the background in the photograph, Casey was In-house counsel of Kia Motors America.

Leave a Reply