Ron Friedmann critiques report on Alternative Legal Service Providers

Hard on the heels of Heather Suttie’s No Alternatives Anymore post on Dialogue, Ron Friedmann critiques the recent Georgetown report on Alternative Legal Service Providers 2019.

Perhaps influenced by the subtitle, “Fast Growth, Expanding Use and Increasing Opportunity”, the many articles covering it suggested the findings portend trouble for law firms. I read the report differently.

Below, I focus on a few findings and statements that stuck out for me. This is not a summary so I recommend reading the entire report to learn more about alternative legal service providers.

The report is by “Thomson Reuters Legal Executive Institute, in partnership with Georgetown University Law’s Center on Ethics and the Legal Profession, University of Oxford Saïd Business School, and U.K.-based legal research firm Acritas.” I first saw it publicized at the TR Legal Executive Institute blog on 28 January 2019 at Alternative Legal Service Providers Report 2019: ALSP Market Experiencing Rapid Growth & Expanded Use.

- High growth – 12.9% CAGR reported. And a Ron caveat. “In just two years, revenues for alternative legal services providers have grown from $8.4 billion in 2015 to about $10.7 billion in 2017. This represents a compound annual growth rate of 12.9% over that period.” That is 27% over two years, a number I will reference below.

- The methodology section notes “Market size estimates are derived from published figures, industry reports, and Thomson Reuters’ best estimates of the size and revenues of the various players in the ALSP space.”

- So the survey underlying this report did not contribute to the size and growth estimate. The methodology section notes that the study included interviews with 35 ALSPs. It is possible ALSP self-reporting contributed to the estimate but that is speculation.

- It’s very hard to assess how solid these estimates are.

- Interpreting growth. Deal size is down. “Overall, corporate use at least doubled in four of the five most common use cases in two years time.” The doubling here refers to the percent of respondents saying they used an ALSP. For the record “double” means 100% growth.

- With the number of customers growing 100% and revenue growing 27%, arithmetically that means a significant drop in the average size per transaction from 2015 to 2017. Of course, averages deceive; we have no data on the mix of deal sizes. But we can speculate…

- Perhaps many corporates are new customers, just getting starting with ALSPS, and will eventually buy at the same rate as prior customers. If so, then we would see very significant revenue growth, even without adding customers.

- Or perhaps the new customers are testing or evaluating the service. Or buying for limited used cases. In this scenario, we do not know if the jump in numbers will lead to big growth.

- One statement gives me pause about growth prospects: “72 percent of corporate legal departments say they simply prefer to handle the work using in-house resources.” If the survey projects shifts in the attitudes of these non-users, I missed it.

- As I pointed out in my 2018 blog post Why Alternative Legal Provider Market Share May be Limited, law firms change in response to the landscape. As alternative legal service providers grow, many firms change what they do, which can dull ALSP growth.

- In that post I shared Altman Weil CLO report findings that the ALSP share of law department spend has been largely flat for years (respectively for 2015, 2016, and 2017: 6.1%, 6.2%, and 5.2%). I do not know how to square the two seemingly contradictory findings. In general, I favor time series data from annual surveys that ask specific questions about what was spent.

- Some snark: a nascent market? The report opening sentence: “Two years ago, the alternative legal service provider (ALSP) sector was still nascent and poorly defined.” I disagree with that characterization:

- OfficeTiger and Axiom both were in business by the early aughts. Axiom now generates over $300m per year

- Since when is a $8.4B nascent?

- I started consulting for a legal process outsourcing (LPO) provider (arguably the earliest ALSP) in 2003 and then joined Integreon in 2007. Leading LPOs were all growing when I joined.

- So why the nascent characterization?

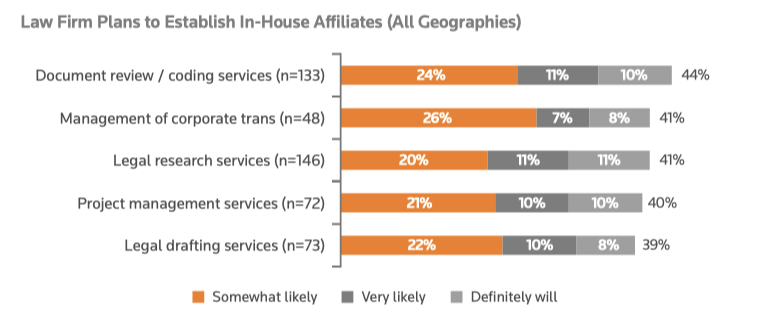

- The big surprise for me: expect many new law firm captive centers. Law firms, like any business, can build or buy services they need. The report notes the challenges of law firms building their own captive ALSP: “A relatively small number of firms have established their own ALSP affiliates. That is not surprising, given the significant barriers to building an in-house ALSP.”

- I agree that building a captive takes time, money, energy, and skills or scale absent in many firms.

- While many of the top 30 UK firms have already established captive centers, a much smaller percent of US firms have.

- The surprise for me is that about 10% of surveyed law firms “definitely will” establish an in-house affiliate, and another ~10% are “very likely” to do so.

- That would be a significant number of new captive centers offering legal support services. Even though we don’t know over what time period this will occur, for me, this is the most surprising finding and the big stand out.:

Conclusions. Clients benefit from choice of different types of legal delivery providers. Competition among providers – law firms, LPO, various consulting firms, ALSP, Big 4, and even in-house – encourages players to deliver better value. Irrespective of my critique of the report, it likely increases client awareness of options, which is good. I regularly note that all the talk of change and innovation counts for little. What does count? General Counsels voting with their dollars. That will drive real change. And anything that encourages the GC to re-think the buying decision is good for the market.

Author

Ron Friedmann, a lawyer, has spent three decades improving law practice efficiency and law firm business operations. He is Chief Knowledge + Information Officer at LAC Group.

He is a Fellow and former Trustee of the College of Law Practice Management and speaks and writes regularly.

The State of Alternative Legal Service Providers was first published by Rob on his long-running Prism Legal blog on February 5, 2019.

Leave a Reply