Economic status of the BigLaw business model

Just released, Citibank’s findings on the economic status of the BigLaw business model make insightful – and to futurists like me, pleasingly confirmatory – reading. Gretta Rusanow of the Law Firm Group in Citi Private Bank and her team have produced an outstanding analysis of the economic facts of BigLaw life and the probable future.

Go the Citibank website to access the whole Advisory.

There is welcome international coverage. The analysis and projections are based on data from sampling of primarily US-headquartered law firms by Citi Private Bank, as well as conversations with law firm leaders. For third-party providers of legal services, while the information is mostly anecdotal, it is very useful.

The report is based on:

- 193 US-headquartered firms, including 44 Am Law 1-50 firms, 34 Am Law 51-100 firms, 47 Am Law 2nd 100 firms, and 68 additional firms, and

- 55 other large firms headquartered in the US, UK, Australia, China, and India.

Part of the summary (which, as the sample suggests, is skewed by US firms) reads: “Revenue growth during the past several years has come primarily via standard rate increases, as realization has been under pressure and the modest demand growth has added limited lift. Headcount growth has come in the form of increased lawyer leverage, as equity partner headcount has remained essentially flat. And margin growth, where firms have been able to achieve it, has come in large part from overhead expense controls as the industry has become leaner.”

The future BigLaw talent model receives special attention

“Looking ahead, we anticipate further changes to the leverage model in response to market pressures. And as the industry has slowed equity partner growth over several years, the result is an aging population. We anticipate an onslaught of retirements in the coming years, raising questions about the size and shape of law firm partnerships in the future.”

George’s comment: The authors’ choice of words is particularly interesting: “aging population” and “onslaught” are not usually part of this discourse. Well done to the authors for putting the related issues squarely on the table.

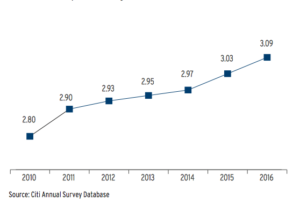

The talent-related chart above (#6 in the Advisory) is clear and provocatively raises difficult issues at all levels from equity partner down to junior lawyer. At stake are traditional career paths and succession management – essential components of the BigLaw business model.

Further, the 2010–2016 trend in lawyer leverage confirms the increasing reliance on leverage  to generate equity partner profits. What a trend line can’t show is the likely future.

to generate equity partner profits. What a trend line can’t show is the likely future.

We are seeing signs that clients are starting to reject paying for lawyers in the junior ranks (many clients see as themselves paying the law firm to train its young lawyers).

The key question is how much longer will this trend in increasing leverage continue?

Tournament of Lawyers

In 1994, publication of the Tournament of Lawyers (University of Chicago Press) by Marc Galanter and Tomas Palay was, in many ways, a harbinger of the circumstances described in this Citibank Advisory. It’s clear, there is a long-term trend occurring.

I commend to Citibank the publication of longer and more granular time series of their data. These would become industry benchmarks to help leaders of BigLaw firms, their clients and the many NewLaw substitutes better understand the economics of the legal services supply chain.

More on the economic status of the BigLaw business model

- 10 reasons why BigLaw managing partners are not sleeping very well by George Beaton

- Growth won’t solve your firm’s problems by Ed Reeser

- Shared lessons for BigLaw firms and taxis by George Beaton

- Evidence why BigLaw firms must start remaking their business model by George Beaton

Super growth or decline? Which firm are you? is a worthwhile read as a complement to the Citibank report. It’s published in Legal Business here: https://www.legalbusiness.co.uk/blogs/comment-super-growth-or-decline-which-firm-are-you/ Editor alex.novarese@legalease.co.uk writes: “No doubt many of the factors underwriting these successes remain elusive, but with the gap between the gravity-defying growth of the winners and the entrenched inertia of the losers being so wide – some of the truisms in the industry about what drives performance look not just in need of revision as flat-out wrong.”