Lost in translation: BigLaw’s communication (and trust) issues

Today celebrated BigLaw leader, chairman emeritus of Seyfarth Shaw LLP, Stephen Poor contributes ‘Lost in translation: BigLaw’s communication (and trust) issues‘ to Dialogue.

We talk a lot about the change needed in pricing legal services. The reality, however, is that the impetus for change in pricing structures will come from the corporate buyers, not the BigLaw sellers, of legal services. In fact, law firm leaders have consistently acknowledged this in every Altman Weil survey for the past 5 years: 66% or more of firms offering services on an alternative fee arrangement (AFA) basis did so “in response to client demand,” rather than acting proactively out of a belief that new pricing models will create a competitive advantage.

Buyers are less conflicted than providers, but “still struggling” with alternative pricing models

The buyer perspective, however, throws an interesting curve ball. As has been the case for many years, the 2015 Altman Weil Chief Legal Officer Survey indicates that fee discounts and AFAs remain the 2 most frequently used means of cost control.

This year, Altman Weil also asked CLOs to rate the effectiveness of cost control mechanisms, and the responses show AFAs faring poorly in this regard. For survey respondents, price reductions from outside counsel (along with overall reduction of outside counsel use, shifting work in-house, and improved efficiency of internal processes) outperformed AFAs in delivering cost reductions.

Based on these responses, Altman Weil suggests that law departments (and by implication, their outside counsel) are “still struggling” to structure AFAs. I tend to agree. In fact, to date, most AFAs are simply repackaged hourly rate structures.

Dilbert by Scott Adams, 9/9/09

Increasingly so since the recession, this buyer’s market has provided a number of means — rate pressure coupled with volume discounts that usually accompany panel consolidation — for in-house counsel to drive down prices without venturing too far from the beaten path.

Increasing in-house control equates to a vote of no confidence in law firms

The stagnation on the buyer-side, however, is coming to an end. David Wilkins of Harvard Law makes the salient point that a new generation of buyers are coming into control of corporate legal buy and bringing with them a new mindset, summarized in a Harvard Business Review article: “Today’s general counsel increasingly view their fellow corporate executives, rather than outside counsel, as their peer group. They are often hired to bring cost and quality advantages to corporations by working creatively with law firms.”

Coupled with the growing maturity and sophistication of the legal operations profession within in-house departments, we are already beginning to see these changes manifest.

Speaking from experience, however, I suspect the Altman Weil responses hint at deeper fractures in the relationship across in-house and outside counsel.

The unrealized promise of AFAs to facilitate a better value exchange is one of the many reasons that in-house counsel are taking an increasingly hands-on approach to outside counsel management.

In the 2014 survey of CLOs by the Association of Corporate Counsel, 63% of respondents reported bringing more work in-house. In that sense, several trends converge to paint a picture of greater buyer control over the supply chain: the growing role of procurement in legal buy, the material shift of work away from firms to in-house, new approaches to disaggregation across traditional and alternative service providers, and increasing in-house oversight of budgeting, reporting, billing, and matter management.

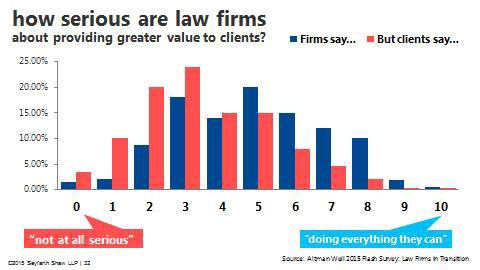

In effect, these choices indicate a vote of no confidence in law firms’ commitment to their clients and/or their ability to deliver greater value. For several years now, the folks at Altman Weil have posed the same question to law firm leaders and in-house chiefs alike:

In point of fact, therefore, the value gap can actually be quantified. While law firm leaders collectively scored themselves a deeply average rating of 4.9, clients gave a much harsher average rating of 3.4. What’s more, that value gap is widening over time, from 1.2 in 2013 to 1.3 in 2014.

This growing gap between law firm and in-house perspectives points to a continuing erosion of trust in a relationship already fraught with misaligned incentives. One of the barriers to broader adoption of AFAs are in-house concerns that the law firm will reap a “windfall” under a poorly constructed contingent agreement.

Dilbert by Scott Adams, 11/26/2003

In turn, these trust issues further erode the potential for meaningful dialogue about what constitutes value to the buyer and how providers should go about creating and delivering that value. (Contrary to what we’d like to believe, this isn’t a challenge that’s limited to the legal function or to the legal industry. PwC’s 2015 survey of global operations personnel indicates that “understanding what customers value” is the most frequently cited challenge for businesses everywhere.)

The value conversation represents a chain of dialogue across many key stakeholders

When we refer to the necessary dialogue between clients and law firms, the conversation is rarely a one-to-one exchange between 2 individuals. In fact, that dialogue represents a chain of communication that spans across organizational silos for both buyer and seller — and a number of points at which the fragile definitions of value can get lost in translation.

In most corporate environments, the law department is a service center for a number of stakeholders across business functions and units. In many cases, the end-buyer of law firm services is not the law department but the businesses themselves. As Wilkins astutely points out, the next generation of in-house counsel see their fellow corporate executives — the business unit leaders that comprise the law department’s internal clients — as their peer group.

There is some evidence to suggest that the communication gaps in the value dialogue extend deeper into this chain across the client organization. While in-house counsel have consistently ranked “demonstrate the value of their own services” as a top priority for the legal function, Consero’s 2014 surveyreports that 66% of GCs find current metrics inadequate to prove the department’s value to the business.

It’s no surprise, then, that the expanded capabilities and greater discipline around data, measurement, and performance management continues to be a key area of focus for the legal ops profession.

The view according to legal ops: lack of clarity on “what qualifies as a win”

Even so, the recently released Blickstein Group survey of legal operations experts provides a mixed view of the current state. On one hand, a staggering 82% of legal ops professionals believe that “corporate legal departments will be the primary driver of innovation and change in the legal sector,” and 52% believe that driving and implementing change is a key challenge for the legal ops profession.

This, too, is in line with broader experience of the operations function at large: 58% of respondents to PwC’s global survey indicate that “finding new ways of creating value” is a primary emphasis, going beyond the continuous improvement of existing processes.

Belying this widespread optimism about the legal function’s ability to drive innovation and change, 76% of legal ops professionals believe that the pesky billable hour will survive the next 5 years. A drilldown on types of AFAs tried provides a picture consistent with the provider perspective: discounted hourly rates far outstripped any other AFA type at 83%, trailed by fixed fee per matter and flat fee to handle “all matters in a given area,” at 69% and 53% respectively.

While it’s encouraging to note that a majority of law departments now have a formal metrics program in place, the top 3 metrics are still cost-driven. In fact, of the 10 metrics listed, 7 focus on spend, 2 relate directly to law firm rates, and none pertain directly to provider outputs or case outcomes.

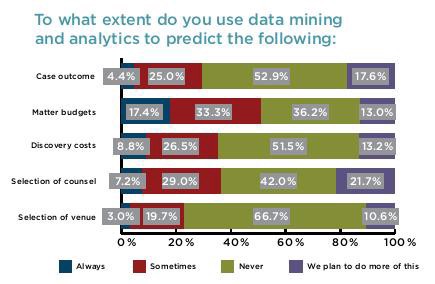

While more than half of respondents reported use of data mining and analytics for matter budgeting at least sometimes, less than 30% of respondents report applying the same approaches to case outcomes.

So, what gives? The foreword by David Cambria, the Global Director of Operations for Law, Compliance and Government Relations at Archer Daniels Midland, gives some insight into why new methods of measuring and pricing legal services may be eluding law departments as well as law firms: “We decide it’s too hard to figure out, it’s too risky, it isn’t the right matter or we’re not clear on what qualifies as a win.”

This rare display of candor may unsettle some, but I think candor is exactly what we need in our industry to drive meaningful progress toward measurements of value rather than inputs and costs.

The truth is that no single player in the legal supply chain has the wherewithal to flip a switch to undo decades of ingrained reliance on the billable hour. Creating the necessary clarity around what qualifies as a win is a shared responsibility across buyer and seller, one that requires commitment, perseverance, and the willingness to experiment.

Author

Stephen J. Poor is chair emeritus of Seyfarth Shaw LLP, in which capacity he serve as an advisor to the firm’s leadership and sponsor of strategic initiatives focused on innovation and growth. Stephen served as the Firm’s chair from 2001 – 2016, leading the transformation of Seyfarth into an international law firm at the forefront of innovation. During his 15-year tenure, Seyfarth grew from nearly 500 lawyers to more than 850 lawyers around the globe.

Stephen J. Poor is chair emeritus of Seyfarth Shaw LLP, in which capacity he serve as an advisor to the firm’s leadership and sponsor of strategic initiatives focused on innovation and growth. Stephen served as the Firm’s chair from 2001 – 2016, leading the transformation of Seyfarth into an international law firm at the forefront of innovation. During his 15-year tenure, Seyfarth grew from nearly 500 lawyers to more than 850 lawyers around the globe.

At the same time, Stephen emerged as a highly influential leader in the legal services industry. He focused on improving service delivery and the client experience, pioneering the application of Lean Six Sigma in legal service delivery and the development of the Seyfarth’s award-winning client service model, SeyfarthLean®. He was named the 2011 Legal Innovator of the Year by the Financial Times, as well as one of Law360’s Most Innovative Managing Partners in 2012.

Lost in translation: BigLaw’s communication (and trust) issues was first published on Seyfarth Shaw’s blog, Rethink the Practice, on March 16, 2016.

Stephen Poor has captured the heart of the issue and the only solution. Getting both parties to the table to collaborate will require a facilitator. Neither has demonstrated an ability to get to “yes” on their own.