NewLaw is in the news

NewLaw is in the news again thanks to an excellent op-ed on the Australian scene by Lachlan McKnight, CEO of Legal Vision in Lawyers Weekly on December 28, 2018: Observations on NewLaw in Australia in 2018.

These are my thoughts in response to Lachlan.

Background

The NewLaw paradigm (aka model or concept), was brought to popular attention in 2013 with the publication of NewLaw New Rules, an e-book produced by collaboration amongst some 40 people around the world.

Those interested in the full story should check out this post published in August 2018.

NewLaw paradigm

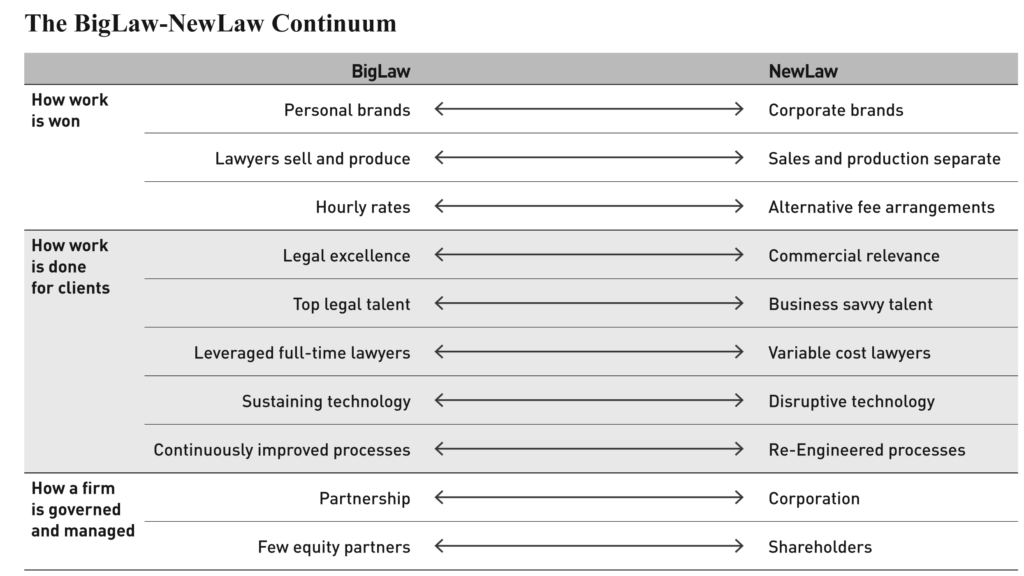

The NewLaw paradigm was conceived as a continuum or spectrum with 10 dimensions to distinguish it from what I termed BigLaw. To communicate the concept, we needed names for each end of the spectrum, hence NewLaw and BigLaw.

BigLawwas not intended to refer only to large law firms. Rather, BigLaw described the 99% of firms, all of which fall at or near left side of the spectrum on the 10 dimensions as the diagram suggests. BTW, I strongly prefer ‘BigLaw’ as a moniker over what some term ‘OldLaw’, which I find pejorative.

Similarly, NewLaw was not intended to connote one type of firm displaying characteristics on the right side of the spectrum

So, what’s a NewLaw firm?

In Remaking Law Firms: Why & How (American Bar Association 2016) with co-author Imme Kaschner, I showed that any traditional firm moving on several dimensions from left to right or a start-up born on towards the right on most, often all, dimensions can appropriately be called a ‘NewLaw’ firm.

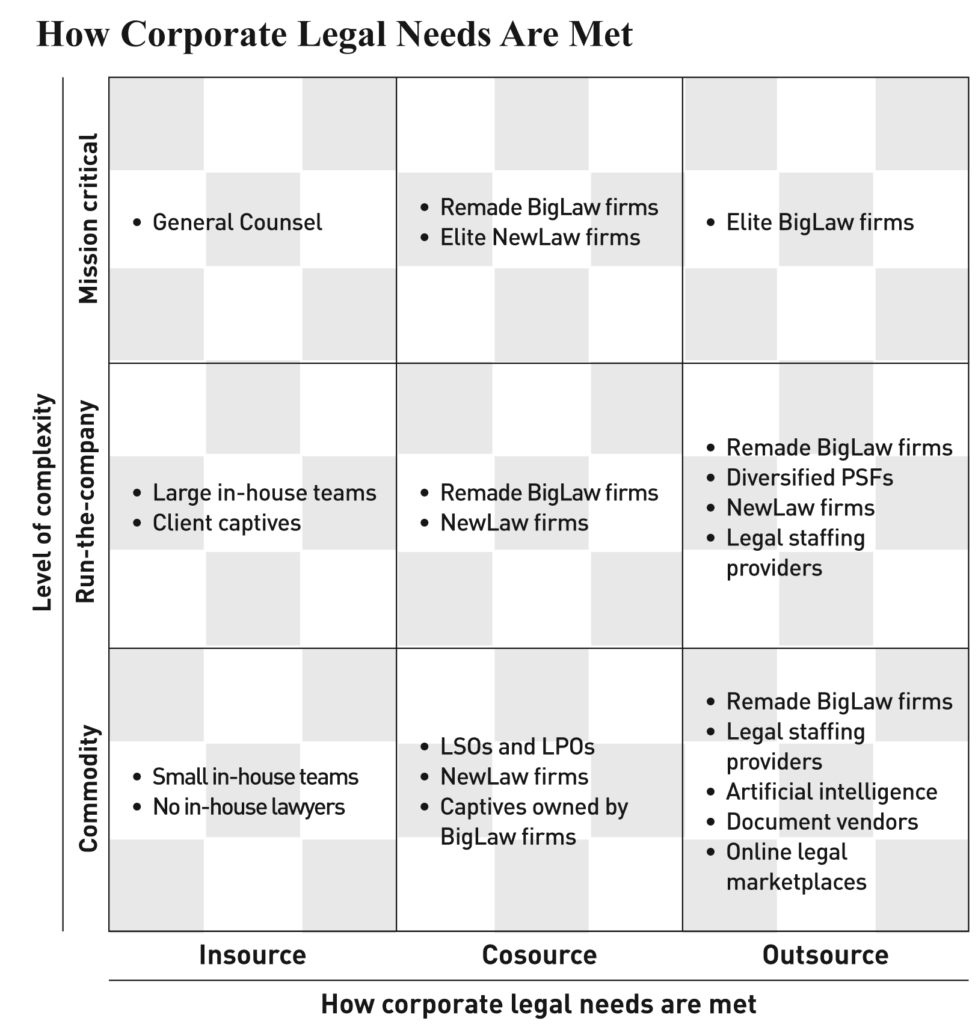

NewLaw is a collective noun for a range of legal services providers, including law departments. In Remaking Law Firms, Imme and I devoted Chapter 5 to what we termed to ‘kaleidoscope’ of providers that would emerge by 2025. The checkerboard graphic portrays this.

Alternative names have proliferated as leaders, founders and observers strive to create – or remake in the case of BigLaw – business models for legal services providers that meet clients’ needs better, faster and cheaper than the traditional way. These names include alternative business models, alternative legal service providers, and law companies.

What of Lachlan McKnight’s observations?

“Over the past three to five years, NewLaw providers have become more and more prominent across the legal landscape. The NewLaw industry has certainly come along in leaps and bounds this year alone, and I thought it would be a good time to set out some observations on where we are now as an industry, and where I think we’re going.”

1. Most NewLaw firms aren’t doing anything different

I would say most traditional firms that say they are ‘NewLaw’ have made a few steps on one or two of our 10 dimensions. I agree “Over the last few years, it’s become fashionable for lawyers setting up a new law firm to market it as “NewLaw”. Ten years ago, their firm would have been called a boutique breakaway.”

2. Fixed-fees are becoming more prominent but are still being calculated based on input

“A fixed fee-based on hours is little different to an hourly rate.” I agree.

3. There’s still more talk than revenue happening in NewLaw

“The amount of coverage NewLaw gets when compared to the actual size of the businesses involved is, however, completely out of proportion.” Supported; read Ken Jagger’s and Liam Brown’s comments on the 5th anniversary of NewLaw New Rules in which both support Lachlan’s contention.

4. The opportunity is bigger than nearly anyone imagines

“If done right, NewLaw firms will destroy the underlying business models of most mid-market traditional firms. Process, systems and technology can bring so much efficiency to the provision of legal services. Traditional law firms are, as a whole, completely under-equipped to deliver this revolution, both from a cultural and a business model perspective. In 20 years’ time, NewLaw providers will have captured up to 30 per cent of the broader legal services market. Traditional mid-tiers will have collapsed. Only those truly differentiated traditional providers will still be in business.” Supported, as the forecast of shares of the supply chain in five regions of the world which Ross Dawson, Ben Farrow and me shows.

5. The customer experience is still not as central to NewLaw as it should be

Agreed! Which is one of the reasons we’re excited about FirmChecker, our start-up built to become the TripAdvisor of medium-small firms.

6. Development and deployment of technology in NewLaw has a long way to go

“The NewLaw providers that will win will be those that put themselves in a position to scale exponentially (breaking the time/revenue/profit equation), and it’s frankly going to be impossible to do this without very significant investments in technology. I think we’re really lagging as an industry on this front.” There’s a view that LegalTech industry consolidation is fast-approaching. If this is correct, then very rapidly, there’ll be a shake-out with a few winners and lots of losers. Speed-to-scale is of the essence.

7. Where’s the capital?

“The recent $65 million raise by Atrium in the US is an indication of what’s to come in this space. As mentioned above, the businesses that win in this space over the next 5–10 years will need to scale exponentially through technology, systems and processes, and there’s no way they’ll be able to do that without raising significant amounts of capital.” Agree

8. The future is here now

Author William Gibson captures Lachlan’s point:

“The future is already here – it’s just not very evenly distributed.”

This is a terrific article, George, thanks to you and Lachlan.

As we know, continuous client input is critical to productive relationships. A couple of years ago, a GC friend told me he’s “not sure if the NewLaw firms have an edge on client service.” He had been disappointed that while fees from a NewLaw firm he used were lower, client service was no better. It was “more of the same, just cheaper.” That dangerous comment should act as a warning, and is why any legal entity – traditional or non-traditional – that avoids having conversations with clients by sticking its head in the sand like an ostrich is apt to get bitten on the butt.

We hear “more of the same, just cheaper” too Heather. It seems to me to be a function of [1] the supply-side (NewLaw) not fully understanding the sophistication and expectations of GCs and [2] the demand-side not yet fully understanding how to manage NewLaw providers who do play by the same ‘rules’ as BigLaw firms. The latter is compounded by the fact that many / most GCs have come from BigLaw firms and are acculturated in BigLaw ways.