Ingredients of enduring BigLaw firms

Ingredients of enduring BigLaw firms is a rejoinder to George Beaton’s recent post, Why BigLaw firms fail. My post explores how the ingredients of enduring law firms work inter-dependently to assure the sustainable success of firms that execute these basics consistently.

In his post, George details our analysis of the most common reasons for law firm failure and concludes that in the majority of cases failure could have been prevented. In Ingredients of enduring BigLaw firms, I set out our work on what makes for an enduring law firm.

Reasons for BigLaw firm failure

- Leadership that was ineffectual, asleep at the wheel, not transparently accountable and, in a few cases, blatantly dishonest

- A wide-spread sense of the firm lacking a direction

- Vulnerability because of exposure to a handful major clients and/or narrow service line offerings

- Poor financial management resulting in ‘nasty surprises’ for the owners and catastrophic cash flow challenges

- Prolonged tolerance of under-performance by a substantial group of equity partnersPerceived inequity in the compensation of equity partners over long periods

- Perceived inequity in the compensation of equity partners over long periods

- Lack of leadership depth because of poor succession management from the top of the firm down to those holding key client relationships

- Merger-related, usually because of cultural misfit

- Massive fraud and/or scandal consuming the firm and destroying market and staff confidence and reputation

- Partner defections – often in the dying days – as large numbers fled the sinking ship.

Ingredients of an enduring firm

When we contrast this analysis of failed firm with an earlier beaton study of the hallmarks of enduring firms, we are able to see that these firms have put in place strategies and structures to shield them from the common causes of failure outlined above.

It’s a truism of the management literature that strategy and risk management are two sides of the same coin. And certainly, our analysis of enduringly successful and failed firms seems to bear this out.

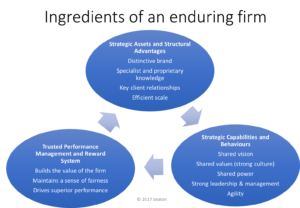

Like many authorities (1) we have organised our analysis under three inter-related headings,

Like many authorities (1) we have organised our analysis under three inter-related headings,

adapted by us for the professional services partnership environment that characterises the great majority of BigLaw firms:

> Strategic assets and structural advantages

> Strategic capabilities and behaviours

> A trusted performance management and reward system.

Strategic assets and structural advantages

Enduring firms find competitive advantage by understanding what value means to clients and creating a client service offering to match.

Our research shows this revolves around being seen having expertise specifically related to the client’s immediate need, demonstrating a deep understanding of the clients’ business and the industry in which they compete, being cost conscious, and easy to work with. (2)

A trusted performance management and reward system

Enduring firms have a trusted and transparent performance management process that defines the role and accountabilities of partners and supports, assesses and rewards each partner’s contribution.

These firms have developed a reward system that is perceived to be fair and clearly aligned with the firm’s vision, values and strategy.

Strategic capabilities and behaviours

Enduring firms work constantly to ensure clarity and agreement on the firm’s vision (why it exists), purpose (where it is heading) and each person’s expected contribution.

The firm’s values are aligned with the vision, understood by all and consistently lived and applied to all without fear or favour by strong leadership and management.

Conclusion

Most BigLaw firm failures arise from an extended pattern of behaviour and decisions that reflect a lack of effective, transparent leadership and direction.

Enduring firms exhibit the opposite. They have strong, accountable leadership working to ensure clarity of vision and purpose. Their leaders act transparently and have mechanisms in place to assure fairness and succession.

Reference

- Exploring Corporate Strategy (8th Edition) by Gerry Johnson, Kevan Scholes and Richard Whittington

- Detailed explanations may be found here and here on Research. Reveal. the beaton research blog.

David Goener, a beaton partner

Leave a Reply