Seeing legal services as a kaleidoscope

As my colleagues and I were researching Remaking Law Firms: Why & How we realized we were seeing the legal services landscape as a kaleidoscope. This vision became one of the pillars of our 2016 book in which Chapter 5 is titled The 2025 Kaleidoscope Scenario.

Less than three years on from the publication of Remaking Law Firms, the kaleidoscope is no longer a futurist’s scenario; it’s already here.  What was speculative then is now reality. The checkerboard is from Chapter 5, portraying how we visualized the future state of the industry.

What was speculative then is now reality. The checkerboard is from Chapter 5, portraying how we visualized the future state of the industry.

Looking from the clients’ side of the desk, we mapped the complexity of work types against the options for sourcing services to do the work.

The resulting nine cells were populated with organizational forms representing traditional and remade BigLaw business model firms, emerging NewLaw firms, corporate law department, legal services and legal process outsource providers, staffing providers, the Big Four, and many forms of technology augmenting or substituting for lawyers.

Today with a few small tweaks, every aspect of this kaleidoscope is indubitably occurring. And while the speeds of the trends vary, e.g. the Big Four are moving faster into legal services than we foresaw, the big picture is as we saw it back then.

We used the kaleidoscope metaphor because the scenario held many shapes and was constantly moving.

Empirically testing the kaleidoscope

In 2016, in collaboration with Ross Dawson and Ben Farrow, I published the findings of a research study: Evidence: Why BigLaw firms must start remaking now.

Our research combined identification of mega-forces with scenarios to assess the impact of the forces on the major types of legal services provider over the next decade.

Our research combined identification of mega-forces with scenarios to assess the impact of the forces on the major types of legal services provider over the next decade.

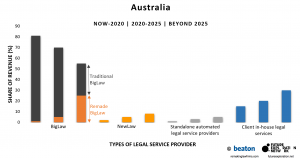

The shares of revenue referred to revenue of traditional and remade BigLaw firms, NewLaw firms, and Standalone automated providers. In the case of Client in-house legal services the measure was the cost of these services to their parent corporations and excludes spending on outside counsel. Shares of revenue are shown in the chart above for Australia in three periods, 2016 to 2020, 2020 to 2025, and beyond 2025. The shares are estimated projections, not precise forecasts, charted to show the temporal trends.

Full details of the method, the charts for the other regions (US, Canada, England and Wales and Western Europe) and our interpretation are set out in our report.

More evidence for seeing legal services as a kaleidoscope

For more evidence for seeing legal services as a kaleidoscope, read the 2018 Altman Weil Law Firms in Transition Report. It’s no wonder traditional BigLaw firms are losing market share:

- “In 69% of law firms, partners resist most change efforts.”

- “Equity partners are not busy enough in 51% of all law firms.”

- “Only 38% of law firms are actively engaged in experiments to test innovative ideas or methods.”

- “Overcapacity is diluting profitability in 58% of all law firms.”

Which leaves the field wide open to those firms that are remaking themselves.

More on facets of the kaleidoscope

A strange finding on the use of NewLaw providers by BigLaw firms

And these books since 2016

- Jordan Furlong’s Law Is a Buyer’s Market

- Bruce MacEwen’s Tomorrowland: Scenarios for law firms beyond the horizon

My questions to readers…

- Where are these trends heading?

- How much more evidence do we need to predict winners and losers in the kaleidoscope?

George Beaton

Leave a Reply